March 31, 2023 | By Jason Myat, Ruth Aung

Real-time Payment

Real-time Payment

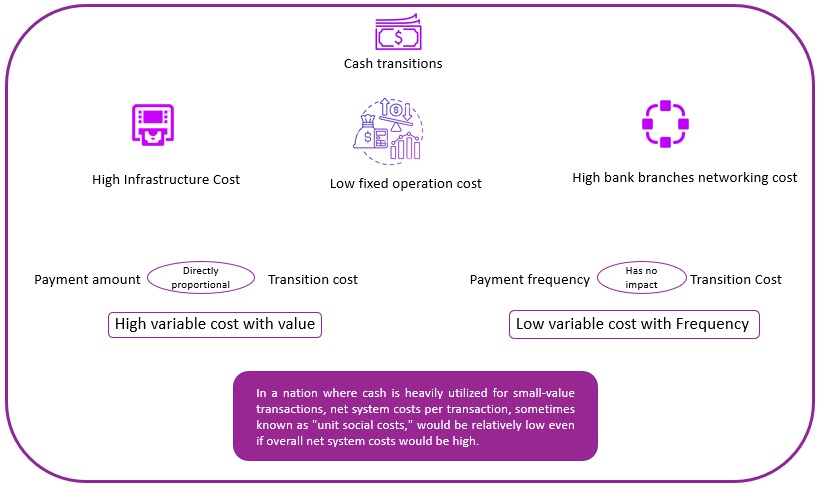

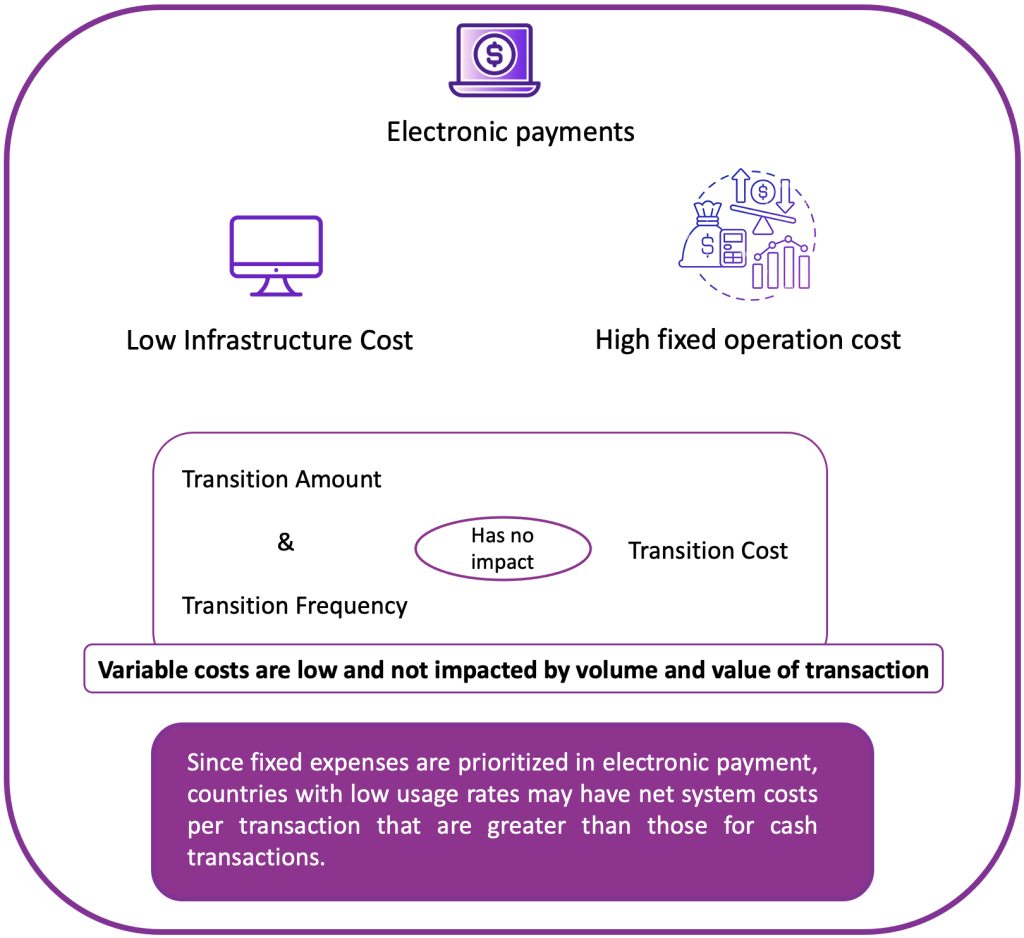

Individuals and their cultural environment have different levels of familiarity with traditional payment systems. People who grew up in third-world countries where cash and cheques are commonly used may be more accustomed to traditional payment methods, whereas those who grew up in countries with better access to digital payment options will be able to accept advanced payments. However, the acceptance of social costs as a significant factor in the payment sector is growing over time. The term “social cost” refers to the economic losses endured by all sectors, such as the price of creating money for the central bank, the amount of time spent waiting for cash or making payments, and the cost of processing cash or check transactions at a retail bank. Traditional payments involve transactions that are cash-based and other payment methods like cheques, demand drafts, and letters of credit. Typically, the Automated Clearing House (ACH) system handles these payments, and the settlement procedure takes a few days. Wire transfers, which are quicker than ACH but still take a few hours or a day to settle, are another option for payments. Every payment method has a social cost on its own.

Individuals and their cultural environment have different levels of familiarity with traditional payment systems. People who grew up in third-world countries where cash and cheques are commonly used may be more accustomed to traditional payment methods, whereas those who grew up in countries with better access to digital payment options will be able to accept advanced payments. However, the acceptance of social costs as a significant factor in the payment sector is growing over time. The term “social cost” refers to the economic losses endured by all sectors, such as the price of creating money for the central bank, the amount of time spent waiting for cash or making payments, and the cost of processing cash or check transactions at a retail bank. Traditional payments involve transactions that are cash-based and other payment methods like cheques, demand drafts, and letters of credit. Typically, the Automated Clearing House (ACH) system handles these payments, and the settlement procedure takes a few days. Wire transfers, which are quicker than ACH but still take a few hours or a day to settle, are another option for payments. Every payment method has a social cost on its own.

As an example of a developed country, the UK had already achieved a strong real-time payment system. The UK’s Faster Payment Services cost GBP 0.14 per transaction in 2008, the first year after the real-time payment launch, then fell with rising transaction volumes to GBP 0.02 per transaction in 2014, according to a 2014 analysis by the Federal Reserve on the potential benefits of introducing real-time payments in the UK. This data indicates that the expenses of the net payment system per real-time payment transaction may be lower than those of other payment systems, particularly those that are not electronic.

A real-time payment is one that allows for instant money transfers between bank accounts and is made to facilitate transactions practically quickly, as opposed to traditional payment methods, which may need a few days for the cash to clear. These payment systems are gaining popularity across the globe because they have numerous benefits compared to traditional payment methods. These payments are made via digital channels like mobile banking applications, internet banking, or electronic wallets, and they are processed and paid promptly, around the clock. For instance, they can aid in lowering transaction costs, boosting productivity, and enhancing security. The real-time payment contains 4 major process

As an example of a developed country, the UK had already achieved a strong real-time payment system. The UK’s Faster Payment Services cost GBP 0.14 per transaction in 2008, the first year after the real-time payment launch, then fell with rising transaction volumes to GBP 0.02 per transaction in 2014, according to a 2014 analysis by the Federal Reserve on the potential benefits of introducing real-time payments in the UK. This data indicates that the expenses of the net payment system per real-time payment transaction may be lower than those of other payment systems, particularly those that are not electronic.

A real-time payment is one that allows for instant money transfers between bank accounts and is made to facilitate transactions practically quickly, as opposed to traditional payment methods, which may need a few days for the cash to clear. These payment systems are gaining popularity across the globe because they have numerous benefits compared to traditional payment methods. These payments are made via digital channels like mobile banking applications, internet banking, or electronic wallets, and they are processed and paid promptly, around the clock. For instance, they can aid in lowering transaction costs, boosting productivity, and enhancing security. The real-time payment contains 4 major process

Payment requests must be submitted by the payer using a mobile app and an internet banking portal in order for the payment to be initiated. The payment request is approved once the payer’s bank certifies that they have sufficient funds and that the requested payment is legitimate. Direct debits are an example of a payment that the payer can pre-authorize before the payee initiates the transaction.

Payment requests must be submitted by the payer using a mobile app and an internet banking portal in order for the payment to be initiated. The payment request is approved once the payer’s bank certifies that they have sufficient funds and that the requested payment is legitimate. Direct debits are an example of a payment that the payer can pre-authorize before the payee initiates the transaction.

After approval, the payment request is transmitted to the payment system for processing. The payment is transmitted to the recipient’s institution by the payment system for processing. As a facilitator between the payer and the payee’s financial institutions, a payment scheme administrator often handles clearing.

After approval, the payment request is transmitted to the payment system for processing. The payment is transmitted to the recipient’s institution by the payment system for processing. As a facilitator between the payer and the payee’s financial institutions, a payment scheme administrator often handles clearing.

The money is received by the recipient’s bank, which immediately credits the recipient’s account. After the money has been credited to the recipient’s account, the payment is regarded as settled. Settlement is the release of payment obligations between the financial institutions of the payer and payee, with the transfer of funds taking place either on a gross basis.

The money is received by the recipient’s bank, which immediately credits the recipient’s account. After the money has been credited to the recipient’s account, the payment is regarded as settled. Settlement is the release of payment obligations between the financial institutions of the payer and payee, with the transfer of funds taking place either on a gross basis.

A notification that the payment has been made as well as completed has now been forwarded to the payer and payee by the respective institutions. The procedure comes to an end with this step.

A notification that the payment has been made as well as completed has now been forwarded to the payer and payee by the respective institutions. The procedure comes to an end with this step.

In developed nations, real-time payments are already more prevalent and expanding. In the future, they are likely to become even more ubiquitous in our country, Myanmar as well. Payment inefficiency, often known as “Payment float,” has long been a concern to several corporate enterprises. For both organizations and consumers, real-time payments may help decrease payment float and create a more effective and secure payment system. To learn more about the payment float, stay tuned for the Real-time payment part 2.

In developed nations, real-time payments are already more prevalent and expanding. In the future, they are likely to become even more ubiquitous in our country, Myanmar as well. Payment inefficiency, often known as “Payment float,” has long been a concern to several corporate enterprises. For both organizations and consumers, real-time payments may help decrease payment float and create a more effective and secure payment system. To learn more about the payment float, stay tuned for the Real-time payment part 2.