June 16, 2023 | By Jason Myat, Ruth Aung

June 16, 2023 | By Jason Myat, Ruth Aung

Moving Towards a Cashless Society

Moving Towards a Cashless Society

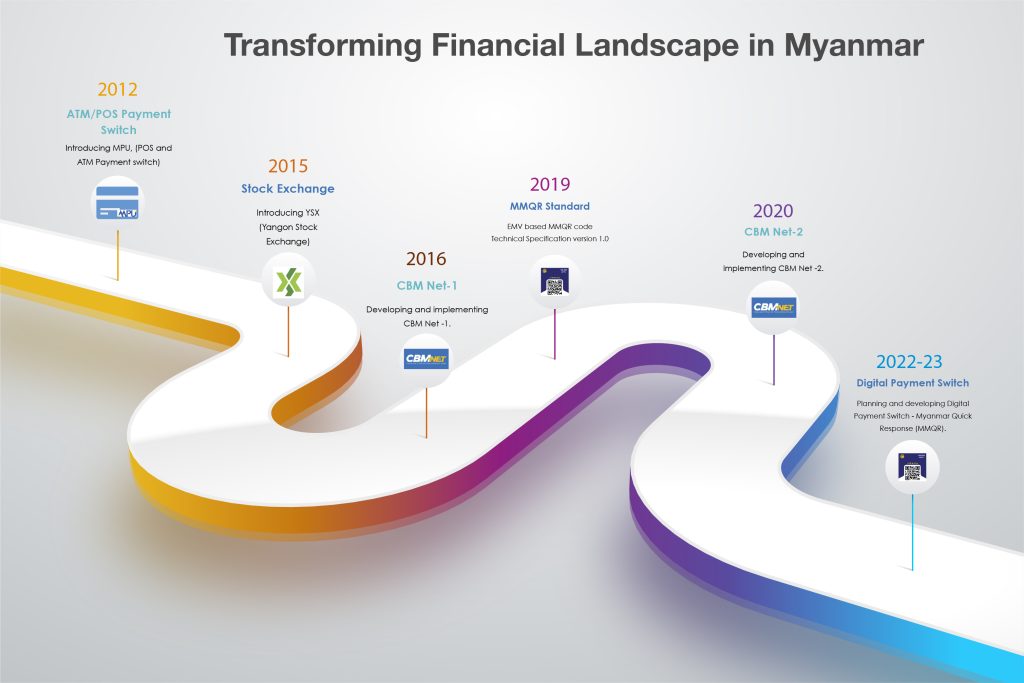

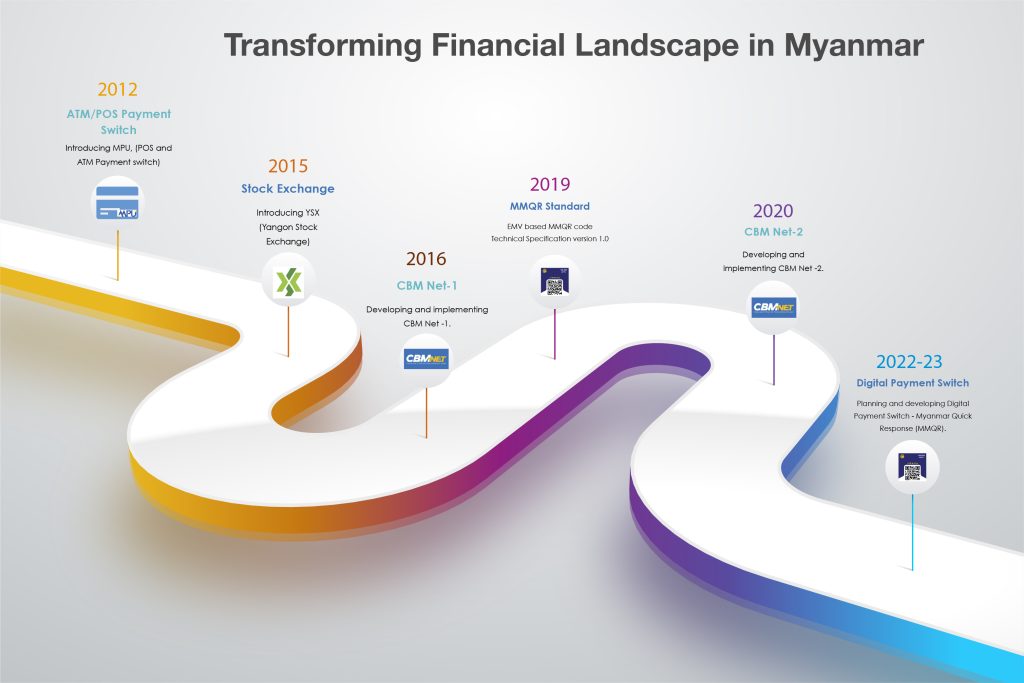

Financial Landscape

Financial Landscape

Benefits At National Level

Benefits At National Level

The digital payment switch does not only benefit individuals of the country but also the overall economy in order to create a cashless society. 1: At a National level digital and financial inclusions could be created to position Myanmar as an economic and financial force including but not limited to supporting SMEs in Myanmar and banking the unbanked population. 2: The digital payment system will help flow the Myanmar Kyats between different financial institutions and in return will help improve the digital Myanmar Kyats usage. 3: This will also act as a door to Cross-Border Economy in SEA regions as the digital payment switch will be the most suitable and secure in implementing cross-border transactions.

The digital payment switch does not only benefit individuals of the country but also the overall economy in order to create a cashless society. 1: At a National level digital and financial inclusions could be created to position Myanmar as an economic and financial force including but not limited to supporting SMEs in Myanmar and banking the unbanked population. 2: The digital payment system will help flow the Myanmar Kyats between different financial institutions and in return will help improve the digital Myanmar Kyats usage. 3: This will also act as a door to Cross-Border Economy in SEA regions as the digital payment switch will be the most suitable and secure in implementing cross-border transactions.

Benefits For Merchants

Benefits For Merchants

Benefits For Public